In a very short time, Pregis LLC acquired a modest blown film extrusion company and turned it into a powerhouse that can compete for packaging business from global customers.

The rapid, three-year expansion has included the addition of new blown film lines from Windmöller & Hölscher (W&H) that give Pregis Films the flexibility it needs to serve large e-commerce customers as well as the specialized, short-run business it inherited. The new lines also allow the company to develop more sophisticated film for new markets.

"E-commerce packaging is a fast-growing market," said Tom Wetsch, chief innovation officer for Pregis. "We more than doubled our e-commerce business in the last couple of years and the next few years our projection is for consistent double-digit increases. We are well-positioned to take advantage of that at Pregis."

Pregis' acquisition of Eagle Film Extruders in 2015 ushered it into an era of rapid growth.

A major manufacturer of protective packaging based in Deerfield, Ill., Pregis has been adding more than one blown film line per year since the acquisition. It is the parent company of Pregis Films.

"We are buying top-of-the-line, state-of-the-art equipment," said Tim Cazzato, manufacturing director for Pregis Films. "It is important to position ourselves to grow as well as position ourselves to support specialty packaging films in the future so that we have a diverse portfolio of business."

At the time of the acquisition, Pregis was buying all its film from outside vendors. With the purchase of Eagle for an undisclosed price, it vertically integrated into film manufacturing to improve performance, quality and capability in that portion of its business. "The acquisition gave Pregis better access to the supply chain, from resin and formulation to film production for Pregis products," Wetsch said.

Eagle had two mono-layer blown film lines and one three-layer line in operation along with an idle three-layer line, all from W&H. Eagle specialized in customized products with shorter production runs, generally in the range of 5,000 pounds to 20,000 pounds. Most of its customers were in the Midwest.

Pregis Films first had to update the older lines. "Some of the older machines got new extruders, new dies, whatever they needed. The older lines are now pretty much like brand-new," Cazzato said during Plastics Machinery Magazine's recent visit to Pregis Films' manufacturing facility in Grand Rapids, Mich. "Pregis spared no expense to bring them up to current standards. The controls on all our lines are now standardized."

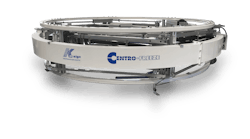

In 2016, Pregis invested $17.1 million to expand the plant, including raising the roof to 100 feet to accommodate bigger equipment and adding a W&H Varex II five-layer 2,200mm line.

Later, it invested more than $1 million for a 1,000-square-foot analytical laboratory for customer-driven R&D, as well as quality testing. "The lab is important for making very specialized films tailored to a customer's specific needs," Cazzato said.

This year, the company added a second Varex II five-layer, 2,200mm line at a cost of $6 million, bringing the total number of lines to six.

"We have placed orders for two additional Varex II five-layer lines," Wetsch said. Both will be operational in early 2019.

Pregis still buys over 50 percent of its film from outside vendors, according to Wetsch. He said he does not expect Pregis Films will ever manufacture all the film it needs because "as we expand globally through acquisitions, our demand for film continues to grow rapidly."

He said Pregis did a lot of homework before it purchased Eagle and more research before it purchased its first W&H five-layer line. "We looked at the capabilities of a lot of machinery manufacturers. We narrowed it down to the top four or five and ran tests with a select group.

"We came to realize from a holistic point of view that the way the W&H system was designed and built made it a better line to build into for the future," Wetsch said. "They build solid turnkey systems. The five-layer lines position us well for the future."

The Varex II line has a modular construction, and Wetsch said the first two machines were specified to what he termed a "generic industry standard." He said an important factor was that the Varex II gives Pregis Films the ability to blend multiple materials per layer across all five layers.

"We configured the lines with high-quality winders, but nothing very outrageous," he said. Additional equipment was added for improved performance and surface treating.

One unique feature of the Pregis Films layout is the nearly 100-foot-high tower on each new machine, considerably higher than is common.

"We like the height for cooling and for material control," Wetsch said. "We produce higher-quality product from taller towers with better lay-flat properties and improved converting when laminated or coated.

"A flexible packaging converter is going to run pouch lines or their laminators, demanding good lay-flat characteristics and gauge control, which they get with our film. We think this provides improved value to our customers. I think we can show customers some pretty good solutions off those lines."

The new equipment has enabled Pregis Films to more than double the pounds of output from the plant since it was purchased.

"I don't see the growth slowing down as we continue to expand in multiple parts of our business and at the same time we are bringing in machinery that is capable of supporting expansion in our other products," Cazzato said.

Pregis focuses on making film for both external customers, as well as for use internally. External customers turn the film into packaging for both food and non-food items, while film used in-house is converted into packaging and wrapping products that include air-filled pillows, cushions and surface protection for new appliances and automobiles.

When Pregis acquired Eagle three years ago, it employed about 35 people. Employment now stands at 130, with Pregis planning to hire another 15 to 20 people to staff the two additional lines. The plant runs 24/7.

Cazzato said W&H has been "phenomenally responsive" to Pregis' needs. "They have been consistent and reliable, and they continue to improve their products.

"The Pregis philosophy is that we are going to get the best equipment and the right people, then we will get the customers. We will be able to compete. Pregis looks at this as a long-term investment. W&H is a good long-term investment."

Pregis Films has a number of resin silos and its own rail spur. The plant uses multiple rail cars of resin each day to serve growing customer needs.

Pneumatic lines move resin from the silos to each film line. The materials-handling system uses AEC pumps. Resin drying is not necessary because the plant does not process hygroscopic resin.

A key factor in managing Pregis Films' growth has been the experienced workers who came with the Eagle acquisition. "Eagle did a lot of short runs and had a highly experienced staff. They were wicked good at doing changeovers," Cazzato said. "They had competency and know-how for blown film production."

Pregis Films currently averages 15 to 18 changes each day for resin type or film structure. A changeover takes from 10 minutes to an hour, depending on the change being performed.

The unemployment rate in the Grand Rapids area is under 3 percent, according to Cazzato, but Pregis Films has been able to find workers. People to fill some leadership and skilled technical positions came from elsewhere in the region and Pregis relocated them to Grand Rapids.

The company is developing a rigorous in-house training program for new hires, Cazzato said. He also credits W&H with providing valuable training when new lines are installed.

Pregis Films' leased manufacturing building is about 55,000 square feet. It also has a separate warehouse in Grand Rapids.

When predicting growth, Cazzato said Pregis analyzes demand, the layer distribution customers might want and the size of extruders it will need in the next three to four years. "We have been putting emphasis on the equipment that will suit our needs for the next five to 10 years," he said.

Ron Shinn, editor

Contact:

Pregis LLC

Deerfield, Ill., 877-692-6163,